An ideal customer profile (ICP) is a crystal-clear description of the perfect company you should be selling to. Forget real customers for a second, this is a fictional organization that gets the most value from your product and represents the perfect fit for what you offer. Think of it as a blueprint for the exact type of account your sales and marketing teams should be chasing.

Why an Ideal Customer Profile Matters

Imagine your ICP is the GPS for your entire business. It's a strategic tool that gives you a clear destination, stops you from wasting time and money on wrong-fit leads, and guides you straight to your most profitable customers. Without a defined ICP, your go-to-market efforts are basically just throwing darts in a dark room. You might hit something, but it’s mostly just luck.

A well-defined ICP moves way beyond basic demographics to build a multi-dimensional view of your target. It's the bedrock of a focused growth strategy, making sure every team is perfectly aligned on who to attract, engage, and keep for the long haul.

The Evolution from Broad to Specific

This concept isn't exactly new, but how we use it has become way more precise. The idea really started gaining steam in the early 2000s with the rise of inbound marketing, which pushed marketers to think more about psychographics than simple firmographics. Fast-forward to 2010, and studies were already showing that B2B companies with solid ICPs could slash customer acquisition costs by 40-60% just by focusing on their best segments.

This shift proves a critical business truth: precision targeting is always more efficient than casting a wide net. To really get this right, you first have to understand how to define a target audience with laser accuracy.

Impact Across Your Entire Business

A strong ICP doesn't just live in a marketing deck; it creates a ripple effect of efficiency and alignment across your entire organization. When every team knows exactly who they’re serving, their efforts become more cohesive and powerful.

Here’s how it helps different departments:

- Marketing: Shapes content, chooses the right channels, and builds personalized campaigns that actually connect with the right people.

- Sales: Sharpens lead scoring, prioritizes who to call first, and refines sales pitches to hit on specific pain points.

- Product Development: Guides the feature roadmap, ensuring you're building what your most valuable and loyal customers actually need.

- Customer Success: Sets clear expectations from the get-go and helps teams anticipate challenges, leading to happier customers who stick around.

An ICP is more than just a marketing document. It's a company-wide compass that aligns every single department toward one common goal, attracting and retaining customers who are practically built to succeed with your product.

This kind of alignment is a non-negotiable part of any effective demand generation strategy, because it ensures marketing and sales are finally working together to drive sustainable revenue.

The Core Components of a Modern ICP

Think of building an ideal customer profile like assembling a high-performance engine. You can't just throw random parts together and expect it to run smoothly. Instead, you need specific, interconnected components working in harmony to generate real power.

A modern ICP is built on four of these pillars. Each one gives you a unique layer of insight that goes way beyond basic demographics, painting a complete picture of the companies that won't just buy from you, but will become your most successful partners.

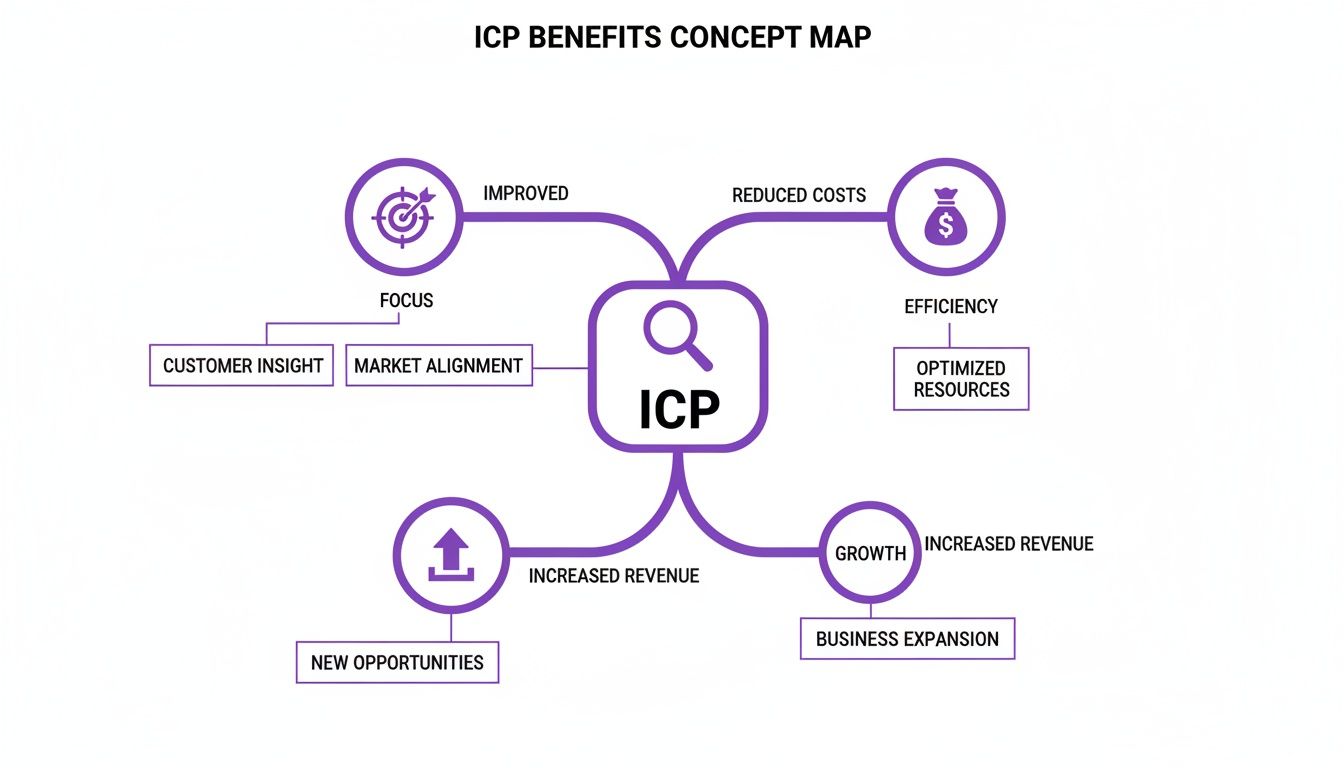

This visual shows exactly how a well-defined ICP acts as a strategic multiplier, focusing your resources where they'll generate the highest return.

Let's break down the four key pillars you need to build a powerful, predictive ICP.

To build a truly effective ICP, you need to look at a company from multiple angles. We've found that the best profiles are built on four distinct types of data. Each one answers a different question about who your best customers really are.

The table below breaks down these four pillars, explaining what each one tells you and what kind of data to look for.

| Pillar | Description | Example Data Points |

|---|---|---|

| Firmographics | The basic, factual "who and what" of a company. | Industry, company size (headcount), annual revenue, geography. |

| Technographics | The technologies a company uses to run its business. | CRM (e.g., Salesforce), marketing automation (e.g., HubSpot), cloud provider (e.g., AWS). |

| Behavioral | How a company interacts with your brand and the market. | Website visits, content downloads, webinar attendance, trial sign-ups. |

| Strategic Fit | The intangible qualities that signal a good long-term partnership. | Company culture, growth stage (startup vs. enterprise), market position. |

Think of it as moving from the general to the specific. You start with broad company attributes and then layer on tech, actions, and cultural fit to get an incredibly sharp picture of your perfect customer.

Firmographics: The Company Blueprint

Firmographics are the foundational "who" and "what" of a company. These are the objective, quantifiable stats that create the basic outline of your target account. Think of them as a company's vital signs.

While these data points might seem basic, they're your most important first filter. They immediately narrow the market from "everyone" to a manageable group of companies that could actually use your solution.

Here are the essentials to gather:

- Industry: Which specific sectors get the most value from your product? A cybersecurity firm, for example, might zero in on financial services and healthcare.

- Company Size: How many employees do they have? This often signals their budget, complexity, and operational needs.

- Annual Revenue: What’s their yearly revenue? This helps qualify their ability to afford your solution and indicates market maturity.

- Geography: Where are they located? This is critical if you have a regional focus, regulatory hurdles, or an in-person sales model.

A great way to organize this data is through effective B2B market segmentation, which provides a solid framework for these foundational elements.

Technographics: Their Tech Stack

Technographics tell you what technologies a company already uses. It’s like looking inside their digital toolbox to see the software and platforms they rely on.

Why does this matter so much? Because a company's tech stack is a massive indicator of its priorities, budget, and operational maturity.

For instance, if you sell a marketing automation plugin that integrates perfectly with HubSpot, then companies already using HubSpot are prime targets. Their existing investment shows they're committed to inbound marketing, making your tool an easy and logical next step.

Behavioral Data: What They Actually Do

While the first two pillars describe who a company is, behavioral data reveals what they do. This is all about tracking how potential customers interact with your brand and the wider market, giving you clear signals of interest and intent.

These actions are the digital breadcrumbs that lead you straight to your most engaged, sales-ready prospects.

Key behavioral signals to watch for:

- Content Engagement: Which companies are downloading your whitepapers, attending your webinars, or spending time on your pricing page?

- Trial or Demo Sign-ups: This is one of the strongest buying signals out there. They're proactively taking a step to evaluate your solution.

- Feature Adoption: For your existing customers, how are the best ones using your product? This helps you spot patterns to look for in new prospects.

This data-driven approach pays off. We've seen companies achieve 24% higher win rates just by analyzing the traits of their top customers, including their tech stack.

Strategic Fit: The Intangible Qualities

Finally, strategic fit captures the less tangible, but equally critical, qualities that determine long-term success. These are the characteristics that go beyond numbers and focus on alignment in culture, goals, and market position.

This pillar helps you dodge customers who look great on paper but are destined to churn because of a fundamental mismatch. It’s about finding partners, not just purchasers.

Consider these strategic fit signals:

- Company Culture: Are they innovative and open to new ideas, or are they resistant to change?

- Growth Trajectory: Are they a high-growth startup or a stable enterprise? Their goals dictate the kind of value they're looking for.

- Market Position: Are they a market leader or a challenger? This shapes their pain points and strategic priorities.

By combining all four pillars, you move from a flat, one-dimensional view to a holistic and predictive ideal customer profile that brings incredible clarity to your entire go-to-market strategy.

Building Your ICP From the Ground Up

Let's be clear: creating your ideal customer profile isn't some abstract exercise you do on a whiteboard with a bunch of guesses. It's a strategic process, and the blueprint is already hiding in plain sight, inside your own company. Your future best customers look a lot like your current best customers. The real work begins by looking inward to figure out who already loves what you do and why they get so much value from it.

Think of yourself as a detective. Your most successful customers have left a trail of clues for you in your CRM, product usage logs, and even in casual conversations with your team. Your job is to gather that evidence, spot the common threads, and build a cohesive profile that can guide your entire GTM strategy.

This process is a mix of hard data and human insight. You need both to create a profile that’s not only accurate but also genuinely useful.

Start With Your Best Existing Customers

The most reliable way to figure out who you should be selling to is to study who you're already winning with. Your happiest, highest-LTV customers are the living, breathing embodiment of your ICP. These are the folks with low churn rates, high product adoption, and the ones who are always willing to give you a glowing testimonial.

First things first, pull together a list of these "super users." Who are they, really?

- Your largest deals: Which accounts represent your most significant contracts?

- Your most active users: Get with your product team and pinpoint the companies with the highest engagement and feature adoption.

- Your successful upsells: Which customers have expanded their contracts or bought additional services without a fuss?

Once you have a solid group of 5-10 companies, it's time to hunt for the common threads. What do these organizations all have in common? This first pass forms the quantitative backbone of your ICP.

Dig Into Quantitative Data

With your list of top customers in hand, it’s time to get your hands dirty in your internal data. Your CRM and product analytics are goldmines of objective information just waiting to be tapped.

Start asking questions as you comb through the data:

- What's their average company size? Look at both employee count and annual revenue to find that sweet spot.

- Do they share a common industry? Are they all in SaaS, fintech, or some other specific vertical?

- Where are they located? Is there a geographic pattern in a certain city, state, or country?

- What tech do they use? Do they all rely on Salesforce, run on AWS, or use a specific marketing automation tool?

These hard data points give you the initial filters for your ICP, helping you slice down your total addressable market into a much more focused, high-potential segment. For a deeper dive, check out our guide on effective B2B data enrichment strategies.

Gather Qualitative Insights From Your Teams

Data tells you the "what," but it rarely explains the "why." To get at the real motivations, pain points, and goals of your ideal customers, you need to talk to the people who are in the trenches with them every day: your sales and customer success teams.

These teams hold invaluable frontline knowledge that you'll never find in a dashboard. Set up some time to interview them and capture those qualitative gems.

Your sales and customer success teams are the keepers of your customers' stories. They know the challenges that led prospects to you, the objections they overcame, and the "aha!" moments that sealed the deal.

Ask your teams targeted questions to get the story behind the numbers:

- What specific pain points were these customers trying to solve before they found us?

- Who was the real decision-maker in the buying process?

- What was their "aha!" moment when they knew our product was the right fit?

- How has our solution actually helped them hit their business goals?

This step adds rich, human context to your data, turning your ICP from a sterile list of attributes into a realistic, actionable portrait of a company.

Synthesize and Document Your ICP

Alright, now it’s time to bring it all together. Combine the quantitative data from your research with the qualitative insights from your team interviews. The goal is a single, clear document that details every piece of your ideal customer profile.

Your final ICP doc should be more than a checklist; it should tell a story about the type of company that's built to succeed with your product. Organize your findings into the four core components we covered earlier.

Example ICP Snippet

- Firmographics: B2B SaaS companies in North America with 50-250 employees and $10M-$50M in ARR.

- Technographics: Actively use HubSpot for marketing, Salesforce for sales, and AWS for infrastructure.

- Behavioral Signals: Regularly attend industry webinars on product-led growth and have a dedicated content marketing team.

- Strategic Fit: High-growth companies aiming to scale fast, with an innovative culture that embraces new tech to get a competitive edge.

By putting this comprehensive profile on paper, you give your entire organization a clear, unified target to aim for. This alignment ensures that marketing, sales, and product are all pulling in the same direction to attract, convert, and retain your absolute best customers.

How to Validate and Refine Your ICP

Nailing down your ideal customer profile is a huge first step, but it's the starting line, not the finish line. An ICP isn't some static document you frame and forget. Think of it as a living hypothesis about who your best customers really are, one that needs to be constantly tested against real-world data to stay sharp.

Markets change, customer needs shift, and your product evolves. If your ICP is frozen in time, it’ll quickly become an outdated map, leading your entire go-to-market team in the wrong direction. The validation process is what turns your ICP from a well-researched theory into a proven, revenue-driving asset.

Using Metrics to Test Your ICP Hypothesis

The only way to know if your ICP is truly "ideal" is to see how it impacts your bottom line. You need to track how leads and customers fitting your profile perform compared to everyone else. This is where the rubber meets the road.

Here are the key metrics that will tell you if your hypothesis is on the right track:

- Lead-to-Opportunity Conversion Rate: Are leads who fit your ICP turning into qualified sales opportunities at a higher clip? This is your first signal that you're attracting the right crowd.

- Sales Cycle Length: Do deals with ICP accounts close faster? A shorter sales cycle usually points to less friction, a clearer value prop, and fewer objections, all signs of a perfect fit.

- Customer Lifetime Value (CLV): This is the ultimate test. Your best customers, your ICP customers, should stick around longer, buy more, and ultimately have a much higher CLV.

Consistently tracking these numbers gives you objective proof of your ICP’s value and helps you pinpoint which characteristics are driving the most success. This data is also critical for figuring out how big your real market opportunity is. You can learn more about this in our guide on how to calculate your Total Addressable Market.

To keep things organized, here’s a quick look at the metrics you should be monitoring to make sure your ICP is actually working for you.

ICP Validation Metrics You Should Track

| Metric | Why It Matters | Success Indicator |

|---|---|---|

| Lead-to-Opportunity Rate | Measures if your marketing is attracting the right kind of attention from companies that are a good fit. | A significantly higher conversion rate for ICP-aligned leads. |

| Win Rate | Shows how effectively your sales team can close deals with ICP accounts versus non-ICP accounts. | A higher win rate for opportunities within your ICP. |

| Sales Cycle Length | A shorter cycle suggests less friction, fewer objections, and a clearer understanding of your value proposition. | Deals with ICP accounts close noticeably faster. |

| Average Contract Value | Indicates if ICP customers are willing to invest more in your solution, reflecting a stronger perceived value. | Higher initial deal sizes from ICP customers. |

| Customer Lifetime Value | The ultimate measure of a great customer relationship, combining retention, upsells, and overall profitability. | ICP customers have a substantially higher CLV over time. |

| Product Adoption Rate | Shows if ICP customers are engaging with your product's key features, which is a leading indicator of long-term success. | Faster and deeper adoption of core features. |

| Customer Satisfaction Score | Measures happiness and satisfaction, which directly impacts retention and referrals. | Consistently higher CSAT or NPS scores from ICP customers. |

Tracking these KPIs will give you a clear, data-backed picture of whether your ICP is a strategic asset or just a document gathering dust.

Establishing a Continuous Feedback Loop

Numbers tell a huge part of the story, but not the whole story. The qualitative insights from your sales, marketing, and product teams are pure gold for refining your ideal customer profile. You need a formal system for gathering their frontline observations.

This feedback loop keeps your ICP grounded in the day-to-day reality of your business.

- Sales Team Debriefs: Set up regular chats to dig into which ICP accounts are easiest to sell to and why. What messaging hits home? What objections keep popping up? Are any non-ICP accounts turning out to be surprisingly great fits?

- Marketing Campaign Analysis: Look past just the conversion rates. Which blog posts, ads, or webinars are drawing in the most ICP-aligned leads? This is how you fine-tune your messaging and channel strategy.

- Product Usage Insights: Get with your product team to see how ICP customers use your product. Are they adopting sticky features faster? Submitting fewer support tickets? These are strong signals of a good fit.

An ICP that isn’t regularly updated with feedback from customer-facing teams is an ICP that’s slowly dying. It loses touch with the reality of the market and becomes an academic exercise rather than a strategic tool.

This process ensures your profile becomes a shared understanding across the company, one that adapts and gets smarter over time. Brands that truly get this ICP-driven approach right are 71% more likely to achieve high customer loyalty.

But siloed data is still a massive hurdle. Recent reports show that 21% of established brands are actually seeing their customer experience decline because teams aren't sharing information effectively. You can discover more about this in the future of customer engagement on Segment.com.

This constant cycle, measure, gather feedback, adjust, is what turns a good ICP into a great one, making sure it stays your most valuable strategic asset.

Activating Your ICP Across the Business

An ideal customer profile gathering dust in a shared drive is just a nice-to-have. It's a theoretical exercise. The real magic happens when you weave it into the daily rhythm of your business, turning it from a static document into a living, breathing strategy that drives revenue. Think of it like programming your GPS, it's useless until you start the engine and let it guide every turn.

When your ICP is fully activated, it creates a powerful ripple effect of clarity and focus. Suddenly, your entire organization aligns around a single vision of who you serve and why. This isn't just about getting teams to play nice together; it's about making every single action more intentional and effective.

Driving Precision in Marketing

For marketers, the ICP is the ultimate cheat sheet. It tells you not just who to target, but how to connect with them in a way that actually feels meaningful. Instead of casting a wide, expensive net, you can build campaigns that hit home with your perfect audience.

Here’s how marketing teams put an ICP to work:

- Content Strategy: You start creating blog posts, whitepapers, and webinars that speak directly to the specific pain points and goals of your ideal customers. No more guessing.

- Channel Selection: Stop wasting budget on platforms your ideal customers ignore. Focus your resources on the social networks, communities, and publications they actually read and trust.

- Personalized Campaigns: Move beyond generic "Hello, {first_name}" messages. Use ICP attributes to craft email sequences and ad copy that speak to a company’s specific industry, size, and challenges.

This isn’t just theory. Businesses that get serious about their ICP see dramatic improvements in marketing efficiency. According to one study, targeted campaigns can boost conversion rates by up to 71% compared to a spray-and-pray approach. You can get more insights on how ICPs drive marketing efficiency at Adcore.com.

Sharpening Sales and Product Efforts

Beyond marketing, a well-defined ICP gives your sales and product teams a massive leg up. It provides the clarity they need to prioritize their efforts and build solutions that truly matter to your most valuable customers.

For sales, the ICP acts as a powerful filter. It helps them instantly spot high-potential leads and stop wasting time on poor-fit prospects who were destined to churn anyway. This leads to sharper lead scoring, more focused prospecting, and sales pitches that land with incredible precision because they’re tailored to the prospect's world.

An activated ICP transforms your go-to-market strategy from a collection of departmental goals into a single, cohesive engine for growth. Every team knows the destination and has a clear map to get there.

Meanwhile, the product team can use the ICP as its North Star. Instead of building features based on the loudest customer or internal guesswork, they can prioritize updates that solve the most pressing problems for your ideal customers. This ensures you’re building a product that not only attracts the right companies but also keeps them successful and loyal.

A Practical Use Case with Brand.dev

Let's make this tangible. Imagine you're a SaaS company whose ICP includes fast-growing tech startups that use HubSpot. With a tool like Brand.dev, you can automate this entire process the moment a new user signs up.

- Instant Enrichment: A user signs up with their work email. The Brand.dev API instantly pulls firmographic and technographic data, including their industry, company size, and tech stack.

- Automated Segmentation: Your system automatically checks if the new lead matches your ICP criteria, are they a tech startup? Do they use HubSpot? Check and check.

- Personalized Onboarding: If it's a match, they’re automatically routed into a personalized onboarding flow with content and examples specifically for HubSpot users. Engagement and adoption go way up.

This kind of automation turns your ICP from a manual checklist into a dynamic, real-time system that ensures your best-fit customers get a world-class experience from day one.

Common ICP Mistakes and How to Avoid Them

Building an ideal customer profile is a massive strategic advantage, but a few common missteps can turn your shiny new ICP into a useless document collecting digital dust. Knowing these pitfalls ahead of time is the key to creating a profile that actually drives focus and clarity.

One of the most common traps is building a profile on assumptions and gut feelings instead of hard data. This almost always leads to an ICP that reflects who you wish your customers were, not who they actually are. The fix is simple: ground every single decision in quantitative data from your CRM and qualitative insights from your sales team on the front lines.

Another classic mistake? Making your profile way too generic.

A vague ICP like "tech companies in the US" isn't a target, it's a phone book. A truly effective profile needs to be sharp enough to actively exclude poor-fit customers, so you can pour all your resources into high-potential accounts.

Keeping Your ICP Relevant and Actionable

An ideal customer profile is not a "set it and forget it" document. If you treat it as a one-and-done project, I guarantee it will be obsolete within a year as your market, product, and best customers evolve. To keep it from going stale, build a continuous feedback loop and schedule regular reviews, at least quarterly, to tune it up with fresh data and insights.

Finally, even the most brilliant ICP is worthless if nobody uses it. If your sales, marketing, and product teams don't understand, trust, and actually apply the profile in their day-to-day, the entire effort has failed.

- Solution: Get key people from each department in the room during the creation process.

- Action: Run workshops showing them exactly how the ICP makes their specific jobs easier and more effective. This turns it from a theoretical document into an indispensable tool.

The shift from basic demographics to these data-rich blueprints has completely changed the game in B2B. In fact, companies that continuously refine their ICPs report 86% higher satisfaction among their B2B customers, who now expect brands to know them inside and out. You can find a deeper dive on how to build a modern a at Saletancy.com.

Got Questions About Your ICP?

As you start putting your ideal customer profile to work, a few questions always seem to pop up. Let's clear the air on the most common ones so you can move forward with confidence.

ICP vs. Buyer Persona: What’s the Difference?

It’s easy to get these two mixed up, but they solve different problems.

Your Ideal Customer Profile is all about the company. It’s the blueprint for the perfect organization you want as a customer, defined by firmographics like industry, employee count, and revenue. Think of it as defining the perfect account.

A buyer persona, on the other hand, zooms in on the individual people inside that company who influence the deal. This gets into their specific job titles, day-to-day frustrations, career goals, and what motivates them. You absolutely need both. The ICP finds the right companies, and the personas help you speak directly to the right people within them.

An ICP helps you find the right forest (the perfect company), while buyer personas help you talk to the right trees (the decision-makers).

How Often Should I Update My Ideal Customer Profile?

Your ICP isn't a "set it and forget it" document. It’s a living tool that needs a tune-up now and then. Markets change, your customers' needs shift, and your own product evolves.

A good rule of thumb is to revisit and refine your profile at least once or twice a year.

But don't wait for the calendar. You should also give it a check-up after any major business event, like launching a new product, pushing into a new market, or if you notice your win rates are starting to dip. This keeps your ICP grounded in reality and ensures it's still pointing your teams in the right direction.

Can a Business Have More Than One ICP?

Absolutely. In fact, it’s pretty common. Many businesses serve different segments or sell a range of products, which often calls for multiple ideal customer profiles.

For instance, a software company might have one ICP for its big-ticket enterprise platform and a totally separate one for its SMB-focused tool. The trick is to build a distinct, well-researched profile for each unique segment you're after. This stops your messaging from getting watered down and keeps each go-to-market strategy razor-sharp.

Ready to stop guessing and start personalizing? Brand.dev provides the real-time company data you need to enrich leads, segment audiences, and activate your ideal customer profile instantly. Get your free API key and start building smarter experiences today.