To calculate customer acquisition cost, you divide your total sales and marketing spend over a set period by the number of new customers you landed in that same timeframe. It's a surprisingly simple formula that tells you exactly what it costs to get a new customer in the door.

Think of it as a crucial health check for your entire growth strategy.

Why Customer Acquisition Cost Is Your Most Important Growth Metric

Before we get into the spreadsheets and SQL queries, let's talk about what this number actually reveals. Customer Acquisition Cost (CAC) isn't just another line item on an expense report. It's a direct reflection of your marketing efficiency, the effectiveness of your sales process, and ultimately, the viability of your entire business model.

This is the metric that separates scalable, sustainable growth from expensive vanity metrics. It’s the number that helps you answer the really tough questions:

- Are our paid campaigns actually making money?

- Should we hire another salesperson or invest more in content?

- Can we actually afford to grow at this pace?

The Rising Cost of Growth

Let's be honest: acquiring customers is getting more expensive. In the SaaS world, CAC has jumped by 60% over the last five years. It's not uncommon for companies to spend $2.00 just to acquire $1.00 of new annual recurring revenue (ARR).

For B2B SaaS companies with longer, more complex sales cycles, that figure can easily hit an average of $1,200 per customer, once you factor in demos, sales outreach, and nurturing campaigns. You can dig into more of these benchmarks in this analysis of acquisition costs.

With costs climbing, a precise handle on your CAC is non-negotiable. Without it, you're flying blind, pouring money into channels without a clue if they're fueling profit or just burning cash.

Understanding your CAC is the first step toward building a predictable growth engine. It transforms your marketing from a cost center into a strategic, measurable investment in your company’s future.

CAC as a Strategic Compass

Think of CAC as the compass for your entire growth strategy. A high CAC might be a red flag that your targeting is too broad or your messaging isn't hitting the mark. A surprisingly low CAC on a specific channel, like SEO, is a clear signal to double down.

By tracking this metric religiously, you build a more resilient and efficient business. It’s the insight you need to build a powerful demand generation strategy that brings in the right kind of customers without breaking the bank.

Gathering the Right Data for an Accurate CAC

Calculating your Customer Acquisition Cost is built on a foundation of good data. The formula itself is dead simple, but the output is only as reliable as the numbers you feed into it. Knowing what to track, and just as importantly, where to find it, is half the battle.

The old saying "garbage in, garbage out" has never been more true. A common mistake is to only count direct ad spend, which gives you a dangerously incomplete picture of your real costs. To get a true, "fully loaded" CAC, you have to account for every single dollar that contributes to winning a new customer.

This means looking far beyond just your Google Ads or LinkedIn campaign budgets. A comprehensive approach ensures your final number reflects the actual investment required to grow.

Identifying All Your Acquisition Costs

The first major piece of the puzzle is your total sales and marketing expenses. Think of this as the complete cost of running your growth engine, not just the fuel. The goal here is to be exhaustive to avoid underreporting, which can lead to some seriously misguided strategic decisions down the line.

Here’s a breakdown of the key costs you absolutely need to include:

- Salaries and Benefits: This covers the gross salaries, commissions, bonuses, and benefits for your entire sales and marketing teams. If an employee splits their time between departments, make sure you allocate their salary proportionally.

- Software and Tools: Tally up the subscription costs for your CRM (like Salesforce), marketing automation platforms (like HubSpot), analytics tools, and any other software your teams use to attract and convert customers.

- Direct Ad Spend: This is the most obvious one, all the money you're spending on pay-per-click (PPC) ads, social media campaigns, sponsorships, and other paid channels.

- Creative and Content Overhead: Don't forget to factor in any costs tied to producing your marketing materials. This includes agency fees, payments to freelance writers, video production expenses, and design work.

And be sure to catch those smaller, often-overlooked expenses. Things like travel for sales meetings, the cost of attending industry events, or even that subscription for a competitor analysis tool. If an expense is aimed at winning new business, it belongs in this bucket.

Defining a Newly Acquired Customer

The second critical piece of data is the number of new customers acquired within your chosen timeframe. This sounds straightforward, but a blurry definition can easily throw off your results. You need a clear, consistent rule for what actually counts as a "new" customer.

For a SaaS business, this is typically a new account that signs up for a paid plan. If you're running an ecommerce store, it's a customer making their very first purchase.

Pro Tip: Be careful to exclude returning customers or existing customers who upgrade their plans. Including them will artificially deflate your CAC, making your acquisition efforts seem more efficient than they truly are.

Your payment processor (like Stripe) or billing system is often the most reliable source of truth here. It provides a clean record of first-time transactions, cutting through the ambiguity that can sometimes come from web analytics alone. Getting a handle on your data sources is critical; you can learn more about this by exploring what marketing analytics tools can offer.

Sourcing Your Data Reliably

With your cost components and customer definition locked in, the final step is pulling the numbers from the right systems. Consistency is everything if you want to track your CAC accurately over time.

To make this easier, I've put together a quick reference table outlining the essential data points and where you'll typically find them.

Essential Data Sources for Accurate CAC Calculation

| Data Point | Description | Common Source(s) |

|---|---|---|

| Team Salaries & Overhead | All compensation and related expenses for sales and marketing personnel. | Accounting software (e.g., QuickBooks, Xero), HR platform. |

| Software Subscriptions | Monthly or annual costs for tools used in sales and marketing. | Accounting software, expense management tools. |

| Paid Advertising Spend | Direct costs for all digital and offline advertising campaigns. | Ad platforms (Google Ads, Meta Ads), analytics dashboards. |

| New Customer Count | The total number of unique, first-time paying customers acquired. | Payment processor (e.g., Stripe), CRM, company database. |

By systematically gathering data from these primary sources, you build a repeatable process. This ensures that when you calculate CAC each month or quarter, you're always comparing apples to apples. That leads to more trustworthy insights and, ultimately, much better business decisions.

Alright, let's get down to the brass tacks. You’ve gathered your data, and now it's time to actually run the numbers on your Customer Acquisition Cost. While CAC can feel like a big, scary metric, the math behind it is surprisingly simple.

The trick is to start with the basics and then layer on more detail until you have a number that genuinely reflects what's happening in your business. We'll kick things off with the simple, blended formula before digging into the more honest, and more useful, 'fully loaded' calculation.

Starting with the Simple CAC Formula

The quickest way to get a pulse on your CAC is with a high-level formula. This gives you a "blended" or "simple" CAC, which averages your acquisition costs across every single channel. Think of it as a great first step to get a ballpark figure.

Here’s the formula:

Simple CAC = Total Marketing & Sales Costs / Number of New Customers Acquired

Let's imagine a SaaS company, "CodeStream," wants to calculate its CAC for Q1 (January 1 to March 31).

- Total Marketing & Sales Costs: $50,000 (This is pure ad spend, campaign costs, and other direct expenses.)

- New Customers Acquired: 200

Plug those numbers in, and you get:

$50,000 / 200 = $250 per customer

CodeStream's simple CAC for Q1 is $250. This tells them it cost, on average, $250 in direct marketing and sales spend to land each new customer that quarter. It's a solid baseline, but it's definitely not the whole story.

Advancing to the Fully Loaded CAC Formula

While the simple formula is a decent starting point, it conveniently ignores some of the biggest costs involved in acquiring customers: the people and the tools. A "fully loaded" CAC gives you a much more accurate picture by factoring in team salaries and software overhead.

The fully loaded formula builds on the simple one:

Fully Loaded CAC = (Total Marketing & Sales Costs + Salaries + Overhead) / Number of New Customers Acquired

Let's revisit CodeStream's Q1 numbers, but this time, we'll add the details needed for a fully loaded calculation.

- Total Marketing & Sales Costs: $50,000 (Same as before)

- Salaries: $75,000 (This covers salaries, commissions, and benefits for the marketing and sales teams for the entire quarter.)

- Overhead & Tools: $10,000 (This includes subscriptions for their CRM, marketing automation platform, analytics tools, etc.)

- New Customers Acquired: 200 (Same as before)

First, we'll add up all the costs:

$50,000 + $75,000 + $10,000 = $135,000 in total acquisition spend

Now, let's run the fully loaded calculation:

$135,000 / 200 = $675 per customer

Suddenly, the picture is much clearer. CodeStream's fully loaded CAC is $675, more than double their simple CAC. This is a far more realistic figure that shows the true capital needed to drive growth. Sticking with the simple CAC would have created a false sense of security, leading to bad budgeting and flawed strategic decisions.

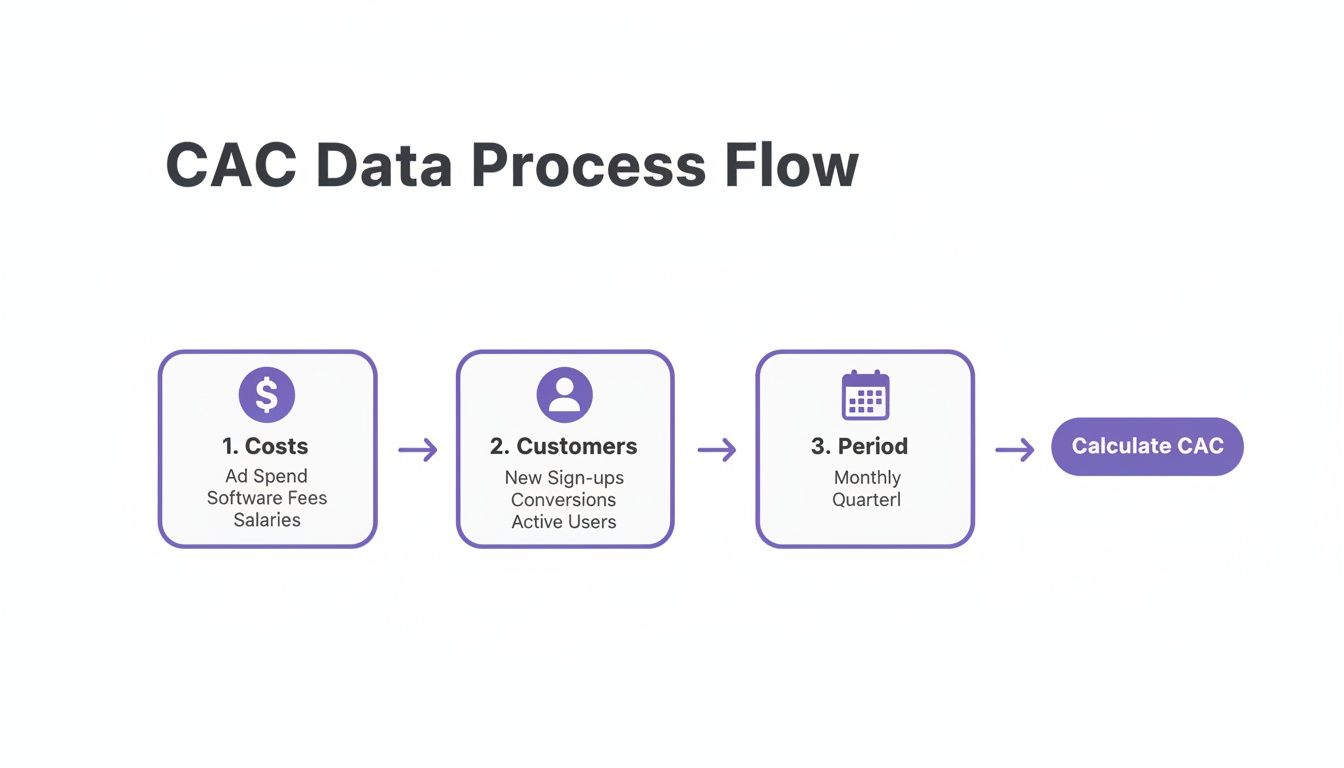

This flow chart breaks down the moving parts you need to get this right, from tallying up your costs to identifying new customers within a specific timeframe.

Ultimately, getting a precise CAC comes down to disciplined data collection across costs, customers, and time. No shortcuts.

Why the Fully Loaded Model Is Essential

For any serious SaaS or developer-focused company, the fully loaded model isn't optional. It’s the only way to get an honest read on the efficiency of your growth engine.

Here’s why it's a non-negotiable:

- Real Profitability: It ties your acquisition spend directly to your P&L, giving you a clear window into your unit economics. Are you actually making money on each new customer?

- Smarter Hiring: When you know the total cost, including people, you can properly evaluate the ROI of hiring that next salesperson or marketer.

- Investor Confidence: VCs and stakeholders expect you to know your numbers inside and out. Presenting a fully loaded CAC shows you’re on top of your metrics and running a mature operation.

For businesses that lean heavily on certain channels, you need to go even deeper. A great next step for a proper and detailed analysis is mastering your Google Ads Customer Acquisition Cost calculation. This kind of platform-specific deep dive is where you'll find massive opportunities for optimization.

By embracing the fully loaded formula, you graduate from a surface-level view to a deep, strategic command of your growth drivers. That's the knowledge that empowers you to build a scalable, profitable business, not just one that chases vanity metrics.

Going Deeper: How Advanced CAC Analysis Unlocks Real Insights

A single, blended CAC number only tells you the first chapter of the story. It's a decent health check, sure, but the real strategic power comes from segmenting your data. Advanced analysis is what turns a simple metric into actionable intelligence, revealing which parts of your growth engine are firing on all cylinders, and which are quietly leaking cash.

This is where you graduate from just knowing your CAC to truly understanding it. By breaking down acquisition costs by channel and customer cohort, you can start making much smarter, more precise bets on where to put your budget and your team’s energy.

Calculating Channel-Specific CAC

It's an obvious truth, but one that gets lost in blended metrics: not all marketing channels are created equal. Some, like organic search, might bring in high-value customers for pennies on the dollar. Others, like paid social, might be expensive but deliver customers fast. A blended CAC completely hides these crucial differences.

Calculating CAC on a per-channel basis is the only way to get a true read on performance. The formula is just a slight twist on the fully loaded model:

Channel CAC = (Channel-Specific Marketing & Sales Costs) / (New Customers from that Channel)

To do this right, you need a reliable attribution model. That means accurately tagging where your new customers come from, whether it’s a specific Google Ads campaign, a blog post, or a referral link.

Let’s say your total blended CAC for Q1 was $675. After digging into your channel data, you find a much different story:

- Paid Search CAC: $950 (Pricey, but these are high-intent users ready to buy.)

- Content Marketing CAC: $320 (Much cheaper, but the payback period is longer.)

- Social Media CAC: $1,200 (Alarmingly high and needs an immediate review.)

Armed with this detail, you can make informed choices. Maybe you need to kill those underperforming social campaigns or reallocate that budget to content, where you’re seeing far better efficiency. For a closer look at measuring channel performance, our guide on analytics in advertising offers some extra context.

The Power of Cohort Analysis

Beyond channels, one of the most powerful ways to slice your CAC is through cohort analysis. A cohort is just a group of customers acquired during the same time period, like "January 2024 Signups" or "Q3 2024 Customers."

Tracking CAC by cohort helps you see how your acquisition efficiency changes over time. It answers the questions that really matter:

- Did our new marketing campaign in Q2 actually lower our acquisition cost?

- Are we getting better or worse at acquiring customers as we scale?

- How did that pricing change in May affect the CAC for new summer cohorts?

By comparing the CAC of different cohorts, you can directly measure the impact of your strategic decisions. For instance, if your March cohort had a CAC of $500 right after you launched a new referral program, while your February cohort was at $650, you’ve got clear evidence that the program is working.

Key Takeaway: Cohort analysis transforms your CAC from a static number into a dynamic story. It shows you the cause and effect of your actions, letting you learn from both your wins and your mistakes.

Benchmarking Your CAC Against Industry Standards

So you've segmented your CAC and you have a ton of data. But how do you know if your numbers are any good? This is where benchmarking comes in. Context is everything, and comparing your performance to industry averages can tell you if you’re a leader or a laggard.

CAC varies wildly across sectors, driven by completely different sales cycles and market dynamics. Ecommerce businesses might average $70-$78, but B2B SaaS is a much steeper $702, and fintech can be an eye-watering $1,450. Even hospitality sits high at $907, while arts and entertainment often benefits from viral sharing with a CAC of just $21. Other sectors like telecom ($694), cleantech ($674), and adtech ($560) all have their own unique benchmarks.

For a deeper dive into optimization, integrating advertising effectiveness measurement into your analysis can provide a more complete picture of your acquisition strategies. When you finally move beyond a single, blended number, you equip your team with the insights needed to build a more efficient, profitable, and sustainable growth machine.

Putting CAC in Context with LTV and Payback Period

Calculating your Customer Acquisition Cost is a great first step, but the number itself is pretty useless in a vacuum. A $700 CAC could be an incredible bargain for an enterprise SaaS platform but a total disaster for a D2C brand. The number only tells a story when you put it up against what a customer is actually worth.

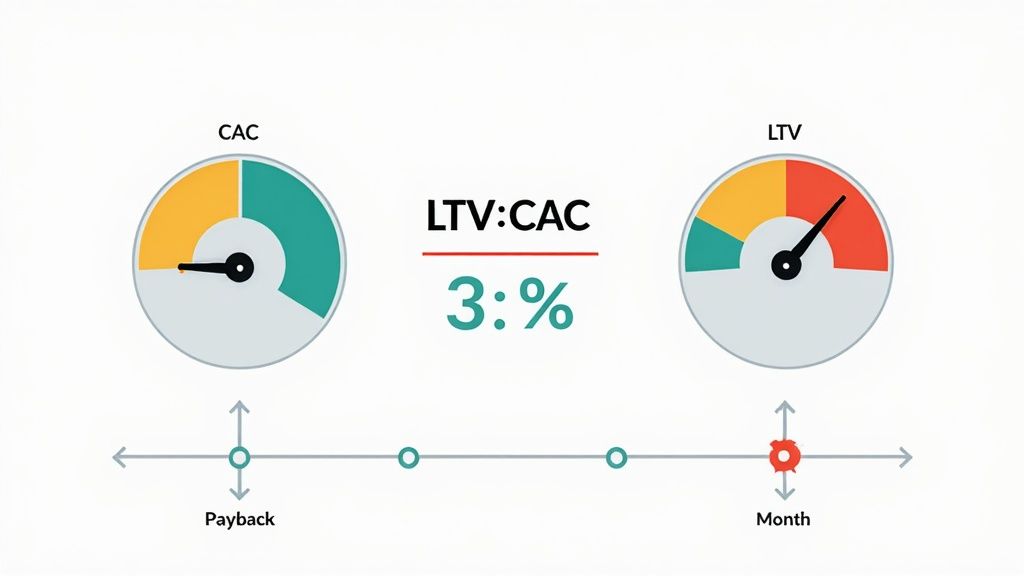

This is where a couple of other key metrics enter the picture: Customer Lifetime Value (LTV) and the CAC Payback Period. These three metrics are the holy trinity of sustainable growth. Without them, you're just tracking an expense instead of making smart, strategic decisions about your business.

The LTV to CAC Ratio: Your Ultimate Health Indicator

The relationship between what you spend to get a customer and what they're worth over time is arguably the single most important metric for any subscription or repeat-purchase business. It answers the one question that really matters: are we acquiring customers profitably?

- LTV (Customer Lifetime Value): The total revenue you can reasonably expect from a single customer over their entire relationship with you.

- CAC (Customer Acquisition Cost): The total cost to bring that customer in the door.

The ratio between these two reveals the long-term ROI of your entire growth engine.

LTV to CAC Ratio = Customer Lifetime Value / Customer Acquisition Cost

If you land at a 1:1 ratio, you’re just breaking even on your marketing spend, which is a recipe for failure once you account for COGS and other operational costs. Anything below 1:1 means you're literally paying to lose customers.

So, what's a good number to aim for? For most SaaS and subscription models, a healthy LTV:CAC ratio is 3:1 or better. This signals that for every dollar you put into acquisition, you get three dollars back in lifetime revenue. That's a solid foundation for a profitable, scalable business.

Understanding Your CAC Payback Period

While LTV:CAC tells you if you're profitable, the CAC Payback Period tells you when. This metric calculates how long it takes, usually in months, to earn back the initial investment you made to acquire a customer. This is all about cash flow.

A long payback period can put a serious strain on your finances, even with a fantastic LTV:CAC ratio. You're floating the business on your own dime while you wait to recoup those acquisition costs. The formula itself is pretty straightforward:

CAC Payback Period (in months) = CAC / (Average Revenue Per Account x Gross Margin)

Let's walk through a quick example. Say your CAC is $600, the average customer pays $100 a month, and your gross margin is 80%.

- Monthly Margin-Adjusted Revenue: $100 * 0.80 = $80

- Payback Period: $600 / $80 = 7.5 months

In this scenario, it takes seven and a half months just to break even on that one customer. For venture-backed startups, most investors want to see a payback period under 12 months. The shorter, the better.

This metric is especially critical in markets where acquisition costs are climbing. In ecommerce, for instance, the cost to acquire a customer has absolutely exploded, jumping from an average loss of $9 per customer in 2013 to a staggering $29 loss today, a 222% increase. This SimplicityDX research summary dives into the data. That kind of spike shows exactly why you can't afford to ignore how quickly you get your money back.

Common Questions About Calculating CAC

Even with the formulas down, you're going to hit some questions when you start calculating customer acquisition cost for real. It’s just one of those metrics with a ton of moving parts, and context is everything.

Let's cut through the noise and get straight to the most common points of confusion. Think of this as your quick-reference guide for the practical realities of using CAC.

What Is a Good Customer Acquisition Cost?

This is the million-dollar question, isn't it? The only honest answer is: it depends entirely on your business model. There’s no magic number, no universal "good" CAC.

For an enterprise SaaS company closing six-figure annual contracts, a CAC in the thousands of dollars might be fantastic. But for a B2C mobile app? They might need to keep it under a dollar just to stay afloat.

The real measure of a "good" CAC is how it stacks up against your Customer Lifetime Value (LTV). It’s all about profitability.

A healthy benchmark for many SaaS and subscription businesses is an LTV to CAC ratio of 3:1 or higher. If you’re spending a dollar to acquire a customer, you want to be damn sure you’re getting at least three dollars back over their lifetime. A 1:1 ratio is a recipe for burning cash, fast.

Ultimately, a "good" CAC is one your business can sustain profitably. It has to be significantly lower than what a customer is actually worth to you.

How Often Should I Calculate My CAC?

The right cadence depends on the speed of your business and what decisions you’re trying to make. For most of us in tech, a blended approach is the way to go.

- Monthly Checks: This is your tactical view. It lets the marketing team react quickly, shift ad spend, and kill campaigns that aren't working. It's perfect for spotting a negative trend before it turns into a quarterly disaster.

- Quarterly Reviews: Looking at CAC every quarter gives you a more stable, strategic picture. It smooths out the monthly bumps, like a blog post that went viral or an unusually slow sales week, so you can see the real, underlying trends in your acquisition engine.

At a bare minimum, you should be reviewing your fully loaded CAC every quarter. This number should be a cornerstone of your financial planning and growth strategy meetings.

What Are the Most Common Calculation Mistakes?

Getting an accurate CAC is all about discipline. So many teams make simple mistakes that give them a dangerously misleading number. Watch out for these three pitfalls:

- Forgetting Key Costs: This is the big one. Only counting your ad spend is a rookie move. If you ignore salaries, sales commissions, software tools, and creative overhead, you'll get an artificially low CAC that makes you feel great, right up until you run out of money. Always, always use a fully loaded model.

- Blurring New vs. Returning Customers: Your CAC calculation must only include newly acquired customers. Tossing revenue from existing customers who upgrade or make another purchase into the mix will make your acquisition cost look much better than it actually is.

- Mismatching Time Periods: A classic accounting error. You can't divide this month's marketing spend by last month's new customers. The costs you include and the customers you count have to come from the exact same time frame. Anything else is just bad math.

Avoiding these mistakes isn't just about getting the metric right. It's about making sound strategic decisions that fuel your company's growth instead of sinking it.

At Brand.dev, we provide the API and SDKs to help you create personalized, on-brand experiences that improve onboarding and conversion. Instantly enrich your product with company logos, colors, and style guides to make every new user feel right at home. Start building for free with Brand.dev.